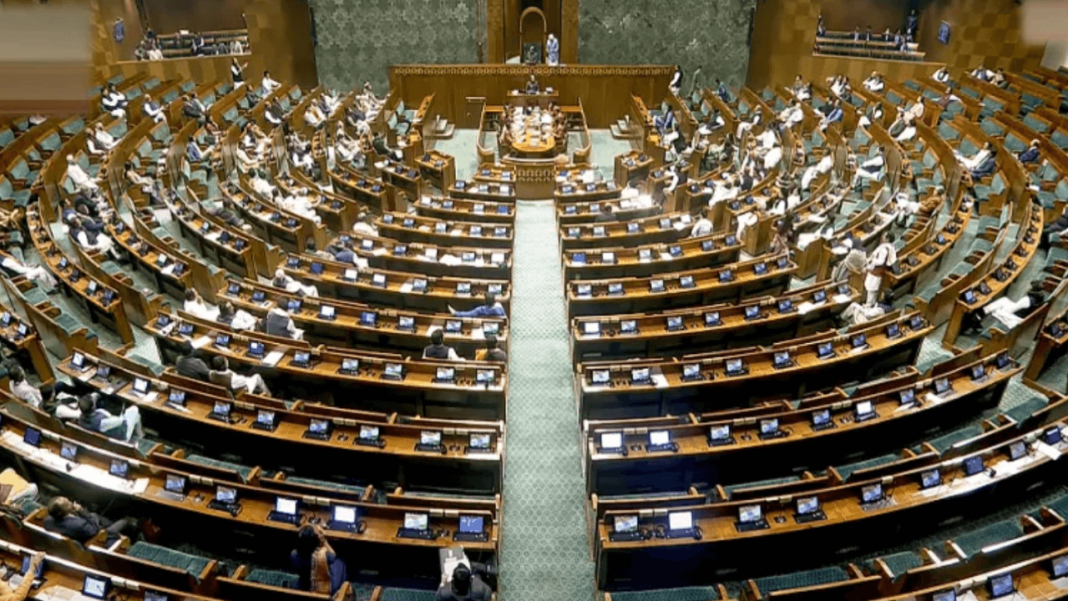

The Winter Session ran on tight timelines and tighter tempers. Still, the work got done. On several days, the House floors felt noisy, even sharp, a mood often reflected in Latest News in India. Microphones clicked on and off, paper stacks kept shifting, and the Chair kept calling for order.

Legislative productivity became a talking point because business moved despite interruptions. Question Hour, debates, and bill discussions kept competing for space. And that is the reality of a short session. The clock rules everything. A bill cleared in that window often carries months of preparation behind it, plus last-minute negotiations that rarely show up on camera.

Comparative Overview of All 8 Bills Passed

| Bill Name | Policy Area | Plain Purpose | What People May Notice First |

| VB Rozgar and Ajeevika Mission (Gramin) Bill | Rural jobs | Rural employment and livelihoods framework | Work planning, wage cycle stability |

| SHANTI Nuclear Energy Bill | Energy | Civil nuclear expansion and structure updates | Longer-term power capacity talk |

| Sabka Bima Sabki Raksha Bill | Insurance | Insurance law changes for wider access | New product rules and disclosures |

| Appropriation (No. 4) Bill | Public finance | Spending authorisation and alignment | Faster fund releases for departments |

| Repealing and Amending Bill | Governance | Removing outdated provisions | Cleaner legal references, fewer clashes |

| Manipur GST (Second Amendment) Bill | Tax admin | State GST rule adjustments | Procedure and filing alignment |

| Central Excise (Amendment) Bill | Tax admin | Excise-related updates | Compliance and rate structure changes |

| Health Security se National Security Cess Bill | Funding | Dedicated cess-linked funding | New levy discussions and tracking demands |

Viksit Bharat–Guarantee for Rozgar and Ajeevika Mission (Gramin) Bill: What It Changes

This bill sits in the rural employment lane, and that lane is always politically sensitive. On the ground, rural job schemes are not theory. They are wages paid on a Friday, groceries bought on a Saturday, school fees handled without panic.

The bill’s stated direction focuses on structured rural livelihoods and job guarantees tied to local works. Supporters argue that planning and accountability improve when targets are clearer and funding flows follow stronger rules. Critics worry about disruption during transition, especially in districts where people already depend on predictable work cycles.

A practical point often gets missed. Local officials need clean guidelines, not fuzzy circulars. If the rules arrive late, or arrive in ten different formats, implementation slows. That is where real frustration builds, not in TV debates.

SHANTI Nuclear Energy Bill: Expanding India’s Energy Landscape

Energy policy tends to sound technical until the power goes out. Then it becomes personal. The SHANTI Nuclear Energy Bill is positioned as an expansion-focused move, aimed at improving capacity and modernising how the civil nuclear sector is managed.

The core discussion circles around participation, regulation, and long-term supply. The pitch is simple: stable baseload power supports industry, transport, and even digital services that now run daily life. The caution is also simple: safety oversight cannot slip, and public trust is hard to rebuild once shaken.

This is where Parliament’s tone matters. A steady, detail-led debate builds confidence. A rushed, slogan-heavy debate does the opposite. The session leaned more toward speed than comfort, at least in public perception.

Insurance Law Amendments Under Sabka Bima Sabki Raksha Bill

Insurance reform always comes dressed as policy, yet it lands in living rooms. A wider insurance net can mean fewer families scrambling after hospital bills or accidents. The Sabka Bima Sabki Raksha Bill carries that broad aim: expand coverage, tidy rules, and make the sector easier to run and easier to access.

Industry watchers also track what it signals for investment, product design, and compliance demands. Insurers like clarity. Customers like simplicity. Regulators like tighter reporting. The hard part is balancing all three without turning the purchase process into a maze of exclusions and fine print.

A small example seen often: a family buys a basic policy, assumes everything is covered, then learns about limits at the worst moment. Reforms that push cleaner disclosures can prevent that kind of shock.

Updates in Taxation and Finance: Appropriation, GST, and Excise Amendments

Some bills look dull on paper, but they keep the government running. Appropriation measures sit at the centre of that. They authorise spending and align budget lines with current needs. Without them, departments stall, payments queue up, and even routine procurement gets stuck.

Alongside that came taxation-linked amendments. A Manipur GST amendment points at state-specific administration needs. Central Excise updates signal ongoing adjustments in legacy tax areas that still exist around the GST structure. These changes usually aim at smoother collections, fewer disputes, and tighter alignment in reporting.

Tax reforms rarely win applause. People notice only when rules get messy. So, clarity is the silent win here, assuming the notifications stay readable and consistent.

New Health Security se National Security Cess: Purpose and Expected Impact

A new cess always triggers a basic question in public minds: who pays, how much, and where does it go. The Health Security se National Security Cess is framed as a funding stream linked to national needs that require steady money, not one-time allocations.

Supporters point to the logic of ring-fenced funding. Health systems, emergency readiness, and security-linked modernisation cost real money, year after year. Critics often ask for transparent reporting, strict utilisation rules, and a clear sunset or review mechanism. That demand is fair. People accept levies more easily when the use is visible and audited.

And yes, the “cess fatigue” feeling exists. Many taxpayers already feel squeezed. That mood matters, even if it does not show up in official statements.

Political Reactions, Parliamentary Debates, and Opposition Response

The Winter Session highlights included sharp exchanges, walkouts, and heavy criticism around priorities and procedure. Opposition voices pressed for deeper debate time, committee scrutiny, and broader consultation. The Treasury benches defended the pace, pointing to the need for timely reforms and legislative closure within the session calendar.

On the floor, it often looked like two conversations running at once. One aimed at the record and the law text. The other aimed at public messaging. That is politics, and it can feel tiring to watch. Still, bills pass only after votes, and votes require numbers, discipline, and planning. The government side showed that discipline. The opposition showed resistance and visibility.

FAQs on the Bills Passed During the Winter Session

1) Why did Parliament pass 8 bills that became the main headline this Winter Session Parliament?

Because eight clearances in a short sitting window show priority-setting, voting discipline, and a push to close pending drafts.

2) What do key bills passed in the Winter Session mean for regular citizens in the near term?

Most impacts arrive through rules, notifications, and implementation schedules, not overnight changes on the day of passage.

3) How do Indian legislative updates turn into real action after the Houses pass a bill?

After passage, the next steps include assent, rule-making, departmental orders, and coordination with states and agencies.

4) Why do finance bills like appropriation and tax amendments keep showing up in Parliament news today?

They keep government spending legal and operational, and they adjust revenue frameworks to match current fiscal planning.

5) What should be watched next for New bills passed India 2025 after Winter Session highlights fade?

Watch the notified rules, budget allocations, implementation deadlines, and the first audit-style reporting on new funding tools.