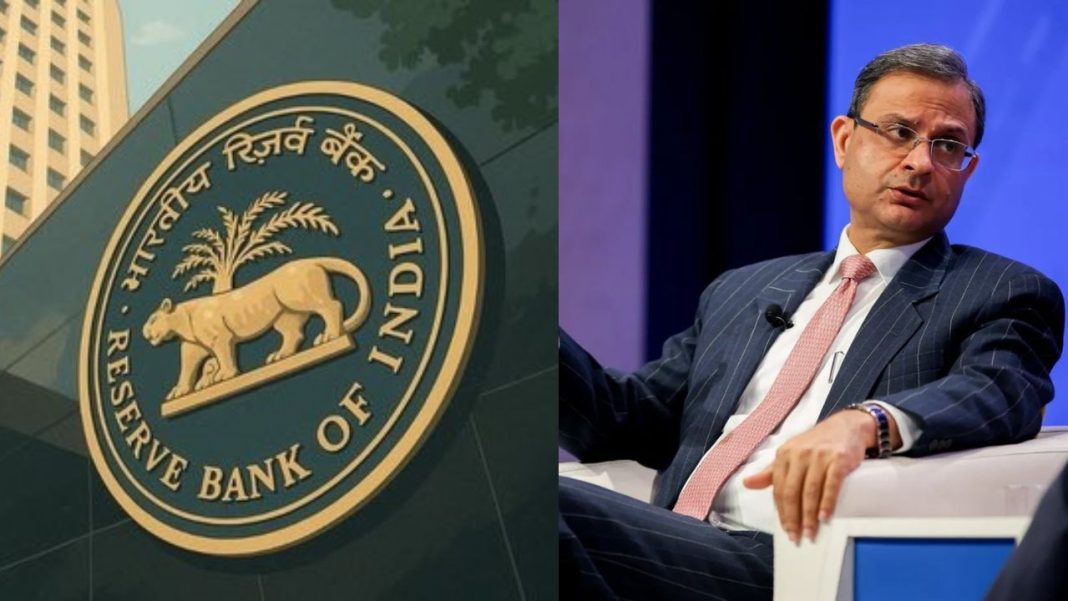

A shop owner in Lajpat Nagar opens the shutter at 10 am, checks the loan EMI message, and sighs. Another month, same number. That small SMS sits in the head all day. The headline now reads: RBI Governor expects a long period of low policy rates for India. For India, a low policy rate outlook can quietly change home loans, business credit, and even hiring plans. It can also change market mood. Some relief. Some confusion. That’s the reality. For Latest News.

Key Highlights from the RBI Governor’s Statement

The RBI Governor’s message is fairly direct: policy rates may stay lower for longer, as long as price pressure stays under control. No dramatic flourish, no shouting. Just a signal that the central bank is not in a hurry to tighten.

Officials also keep repeating one point in plain language: inflation control remains the main job. If inflation behaves, the policy stance stays supportive. If it does not, the tone changes fast. That’s the central bank style. Calm voice, but a firm hand.

Economic Conditions Supporting a Long Period of Low Policy Rates

A low-rate phase usually needs two things. Stable prices and steady growth. Recent readings on retail inflation have looked more comfortable than earlier spikes, especially compared to periods when food prices went wild. Summer heat, vegetable costs, supply gaps, those things still matter a lot in India. Everyone knows it.

Growth has held up better than many expected, helped by public spending, services demand, and better credit flow. The RBI also watches rural demand closely. When rural cash flow improves, small-ticket buying improves too. Soap, tyres, tractors. Those small signals often say more than big speeches.

How Sustained Low Policy Rates Impact India’s Economy

Low policy rates reduce the base cost of money. Banks still decide final lending rates, but the direction becomes clearer. In practical terms, new borrowers often get a slightly softer rate, and some existing borrowers see a reset during their repricing cycle. Not instant. Not magic. Just gradual.

A softer rate environment can lift consumer spending as EMIs feel less tight. It can also help companies take expansion calls with less fear. A mid-sized factory may add one more shift if funding stays cheap and demand holds. But it is never only about rates. Demand must show up. Otherwise, money stays parked.

Sector-Wise Effects of Prolonged Low Interest Rates

Different sectors react in different ways. Housing reacts first because home loan rates sit right in the middle of middle-class monthly planning. Auto loans follow close, because cars and two-wheelers often sit on finance. Small businesses watch working capital rates like hawks. A small change hits margins.

Below is a quick sector view, the kind analysts scribble during a long call.

| Sector | What Changes Under Low Policy Rates | What People Notice First |

| Housing | Lower home loan pricing over time | EMI resets, new loan offers |

| Auto | Easier financing on new vehicles | Dealer schemes, loan approvals |

| MSMEs | Slight relief in working capital cost | Cash-flow pressure reduces |

| Banks | Loan growth can rise if demand stays | Margin pressure, deposit pricing |

| Government borrowing | Borrowing costs stay manageable | Bond yields, auction appetite |

A small frustration remains, though. Deposit holders feel it. Fixed deposit renewals can look less exciting. And that is a real dinner-table complaint.

Global and Domestic Factors Influencing RBI’s Outlook

The RBI does not work in a vacuum. Global rates matter because foreign money reacts quickly to yield gaps. A sharp move by a big central bank can pull funds out of emerging markets. That can weaken the rupee, which can push imported inflation. It’s a chain reaction.

Domestic factors matter even more. Food inflation, fuel pricing, logistics costs, and local supply issues can change the picture in weeks. Anyone who has stood in a crowded mandi knows how fast prices jump. Policy makers also track credit growth and liquidity in the banking system. When liquidity stays comfortable, transmission works better. When it tightens, the story changes.

Risks That Could Disrupt the Low-Rate Environment

A long low-rate phase sounds nice, but it comes with conditions. The biggest risk is an inflation flare-up. Food prices remain the usual suspect. A weak monsoon, sudden crop damage, or transport disruptions can push prices up quickly. And that pressure reaches households fast. Milk, rice, cooking oil. No time lag.

Oil is another risk. A sharp rise can hit import bills, shipping costs, and inflation expectations. Then there is the rupee. If currency pressure rises, imported items get costlier, and inflation can pick up. None of this stays theoretical. It shows up in bills. That’s why the RBI keeps its language cautious, even during softer phases.

What Borrowers, Investors, and Businesses Should Expect Next

Borrowers may see a slow, practical benefit. New loans can get priced a bit better, and existing floating-rate loans may reset gradually. Many banks pass on rate changes with a delay, sometimes irritatingly slow. People complain, and honestly, fair enough.

Investors tend to watch bond yields and bank commentary. Equity markets usually like lower rates, but markets also hate surprises. A stable rate path reduces shock value. Businesses, especially those in capex-heavy sectors, may plan expansion in phases rather than in one big leap. Paperwork, approvals, cash cycles. Real life stays messy.

India’s Monetary Policy Path Compared to Global Trends

Globally, some economies keep tighter policy longer due to stubborn inflation or wage pressure. India’s case often looks different because the inflation basket is heavily influenced by food, and the growth story still has domestic demand strength. That creates room for a softer stance, but only if inflation stays calm.

India also has its own financial structure. A large share of savings sits in bank deposits, not market instruments. That changes how monetary moves travel through the economy. So comparisons with the US or Europe never fit perfectly. Similar headlines, different plumbing.

FAQs on India’s Policy Rates and RBI Decisions

1) What does “long period of low policy rates” mean for home loan customers in India?

It signals slower EMI pressure over time, but actual relief depends on bank transmission and loan reset schedules.

2) Can low policy rates reduce fixed deposit returns for ordinary savers?

Yes, deposit rates often soften during long low-rate phases, so renewals can look less attractive for savers.

3) Why does inflation control still matter even during a low-rate outlook?

Because inflation hurts household budgets quickly, and rising prices can force the RBI to raise rates despite growth needs.

4) Do businesses automatically expand when policy rates stay low?

Not automatically, since demand, cash cycles, and confidence matter, but lower funding costs can support expansion planning.

5) What could push the RBI to change its stance earlier than expected?

A sharp inflation spike, oil price shock, major rupee pressure, or sudden global tightening can trigger a faster shift.